Insights from ITB – How hotels can maximise their revenue performance for the next fair

To maximise the revenue performance during a fair or high impact event might be easier said than done. Many rely on returning business to bring in a safe level of base occupancy to a slightly higher rate and surely their ADR and RevPAR will increase accordingly a couple of euro. But is that enough? What level of risk can you take and how do you know what business mix to choose? What BAR rates should you sell? In this article we want to show you concrete steps to maximize your fairs and actions you can take to achieve truly great results, making sure you’re tapping in to the highest demand segments and ensuring you beat your competition. As an example, to demonstrate our points, we are focusing on the yearly occurring ITB fair in Berlin which just took place last week 8-12th March and how a fictitious 4 star hotel can make sure to optimise its performance.

Set you goals

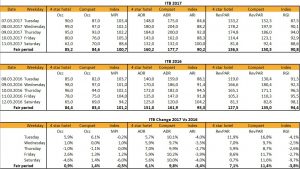

The first thing to do is to set your goals. And by goals I mean your RevPAR goal for each day of the fair. This will be a key to your success and serve as a base for setting your strategies. To do this we will use market share data from our fictitious 4 star hotel and its compset. Here we want to make sure to look at the evolution from previous years.

The main points as seen from the data:

- Hotel has clearly lost from 2016 to 2017 in market share. Assuming a 100% comparable compset, the hotel should be able to reach an MPI, ARI and RGI of at least 100.

- The loss of market share YOY is ARI related, and comes from the fact that compset grew more in ADR than the hotel.

- Saturday, the shoulder night, is the only day in which the hotel should go for an occupancy strategy. This can be concluded from the low OCC of the hotel and the market as well as the MPI and ARI evolution from 2016 to 2017.

- From a market share performance perspective, the weakest day is the pre-arrival Tuesday, which is ADR related. Here hotel must push the prices up

- In general, to reach 100 RGI, the hotel must implement a stronger ADR focus, pushing up the ARI at the probable cost of some MPI share, yielding a more profitable revenue for the hotel.

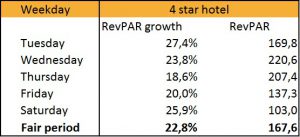

Now, assuming the same yearly growth of the compset being kept until next fair, they will grow further with ca 11,5% in RevPAR. In order for the 4 star hotel to catch up and reach an RGI of 100, the following RevPAR growth must be made to reach the new RevPAR goals per day accordingly:

With the RevPAR goals set, you can further conclude your ADR and OCC targets per day as well.

Set your BAR rates and simulate your segmentation mix

With your goals set, you now carefully have to make sure you reach them. In order to have a clear strategy of how to reach them, before you open up your fair dates for sale, you should know how much volume of each segment and rate product you can take in and to what price. This could include some base occupancy from groups and a mix for individual segments on top. As always, the BAR rate is the main rate and should be defined first. As it represents the highest price point this probably sits somewhere between 10-20% above your ADR target.

Yield accordingly

After having concluded your BAR rate and segmentation mix, make sure the prices are loaded and distributed accordingly and that your yielding strategies are in place as well. For fairs, it is important to always keep straight line availability in mind and make sure you fill your shoulder nights. Hence see whether you need to apply minimum length of stay restrictions for the main days and keep all your cheap contracted prices closed.

Group handling

Based on the volume and prices you need from your group segment, implement and communicate group selling strategies within the hotel accordingly. Make sure the groups stay throughout the fair and helping your shoulder nights. As you can read in our previous article about taking back control if your inventory, make sure you select the right group business and take enough risk. Just because a group has come for the past 5 year, it doesn’t mean you must accept them again or give them any sort of extra discount.

As you should always keep total revenue and profit as a priority, you obviously have to consider if a group has a lot of meeting and event (M&E) revenue spending. For those requests make a displacement calculation. Usually for fairs, the room rate increases are so big so it seldom makes sense to take in a M&E group that is only prepared to pay a “normal” room price even if they bring a good amount of M&E revenue per room. Surely though you should consider this in your displacement calculation.

A tip is to hunt for M&E only groups during the fairs! Basically, fill your rooms with groups who are there for the fair and prepared to pay high room rates, and fill your meeting rooms with local M&E only events. Put a marketing action behind as well because many companies, knowing that there is a fair going on, are reluctant to send out the request in the first place.

Monitor pick up pace and market pricing

With your goals set, strategies in place, and prices loaded, you are now all set to open your hotel for sale. You might wonder why so far we haven’t mentioned anything about considering compset selling prices. The answer to that is that in the beginning it’s not important. The best indicator of your compset’s performance is their RevPAR and you have already considered that when setting your RevPAR and RGI goals. However now going forward you should indeed monitor their selling prices and also those of the larger market. The internal OTB situation however will always be most important and must have priority over compset pricing. Therefore, make sure you monitor your pick up, its pace, and incoming volume in each segment. That information together with monitoring the compset’s prices will serve as your map when navigating towards a perfectly executed fair. Good luck for the next ITB!